Skip to ¶

- The Bank of North America

- The First Bank of the United States

- Second Bank of the United States

- The Creature From Jekyll Island

- The Fraud of 1913

- The 16th Amendment

The most hated sort of wealth getting, and with the greatest reason, is usury, which makes a gain out of money itself, and not from the natural object of it. For money was intended to be used in exchange, but not to increase at interest. And this term interest, which means the birth of money from money, is applied to the breeding of money because the offspring resembles the parent. Wherefore of an modes of getting wealth this is the most unnatural.

The hand that gives is among the hand that takes. Money has no motherland, financiers are without patriotism and without decency, their sole object is gain.

- Napoleon

I place economy among the first and most important of republican virtues, and public debt as the greatest of dangers to be feared.

- Thomas Jefferson

The disaster of the Dark Ages was caused by decreasing money and falling prices… Without money, civilization could not have had a beginning, and with a diminishing supply, it must languish, and unless relieved, finally perish. At the Christian era the metallic money of the Roman Empire amounted to $1,800,000,000. By the end of the 15th century it had shrunk to less than $200,000,000… History records no other such disastrous transition as that from the Roman Empire to the Dark Ages.

Article I, Section VIII of the Constitution of the United States states Congress shall have power…

- to lay and collect taxes, duties, imposts and excises, to pay the debts and provide for the common defense and general welfare of the United States; but all duties, imposts and excises shall be uniform throughout the United States

- to borrow money on the credit of the United States

- to regulate commerce with foreign nations, and among the several states, and with the Indian tribes

- to coin money, regulate the value thereof, and of foreign coin, and fix the standard of weights and measures

The Bank of North America ¶

At the end of the American Revolution, the Continental Congress and its Financial Minister Robert Morris created a privately-owned central bank called the Bank of North America. This bank used fractional-reserve banking, and was given the power to coin money for the United States, and to regulate the value thereof.

At the end of the American Revolution, the Continental Congress and its Financial Minister Robert Morris created a privately-owned central bank called the Bank of North America. This bank used fractional-reserve banking, and was given the power to coin money for the United States, and to regulate the value thereof.

However, the identification of the Bank of North America with commercial interests in general and with Robert Morris in particular proved its undoing, despite a spirited defense by as pedigreed a radical as Thomas Paine. Led by William Findley of western Pennsylvania, agrarian interests attacked the bank as an undemocratic concentration of wealth and succeeded in revoking its local charter. Findley gave voice to the anxieties of agrarian republicans about what they saw as commercial manipulations of the familiar economic order. He argued that the bank was, in essence, impersonal corporate capital that existed “for the sole purpose of increasing wealth.” As such, “the personal responsibility arising from the principles of honor, generosity, etc., can have no place.” Instead, “like a snow ball perpetually rolled, it must continually increase its dimensions and influence.” Such an institution, “having no principle but that of avarice, which dries and shrivels up all the manly, all the generous feelings of the human soul, will never be varied in its object: and, if continued, will accomplish its end, viz. to engross all the wealth, power and influence of the state.”

- Republic of Debtors, Bruce H. Mann

The rich will strive to establish their dominion and enslave the rest. They always did. They always will… They will have the same effect here as elsewhere, if we do not, by the power of government, keep them in their proper spheres.

- Gouverneur Morris, in a letter written to James Madison, dated July 2, 1787

The First Bank of the United States ¶

To further enlist support for a strong central government, in December 1790, Hamilton submitted a report to Congress in which he outlined his proposal for creating a national bank.

Not everyone agreed with Hamilton’s plan for a national bank. Indeed, it met with violent opposition in some quarters. Secretary of State Thomas Jefferson, for one, was afraid that a national bank would create a financial monopoly that would undermine state banks. He also believed that creating such an institution was unconstitutional.

James Madison, who represented Virginia in the House of Representatives, opposed the bank for similar reasons. In particular, he objected to the bank’s proposed 20-year charter, arguing that two decades was too long a period for an untried entity in a country so young.

Other opponents felt that the bank was an affront to states’ rights and would make the states too subservient to the new federal government. Moreover, agreeing with Jefferson, many of the people who opposed the bank said that the Constitution did not grant the government the authority to establish banks. Still others thought that a national bank would have a monopoly on government business, to the detriment of the state-chartered banks.

Despite the opposing voices and much debate in Congress, Hamilton’s bill cleared both the House and the Senate in the winter of 1791. Most support for the bank came from the New England and Mid-Atlantic states. Southern states, which feared the federal government’s encroachment on their rights, were less inclined to support the bill.

President George Washington, however, was undecided as to whether he should sign the bill or veto it. He sought advice from Attorney General Edmund Randolph and Secretary of State Thomas Jefferson, both of whom told the president to exercise his veto power. But, still on the fence, Washington sent documents containing Randolph’s and Jefferson’s comments to Hamilton on February 16, 1791, giving the Treasury secretary one week to respond. Hamilton delivered to the president a lengthy refutation of his fellow cabinet members’ arguments. Washington signed the bill.

By 1791, the First Bank of the United States was established with a twenty-year charter to coin money for the United States, and to regulate the value thereof. Within five years, the new American government had borrowed $8,200,000 from this bank, and prices in the markets throughout the country had increased by 72%. It was at this time in history when Secretary of State Thomas Jefferson made the statement, “I wish it were possible to obtain a single amendment to our constitution taking from the federal government their power of borrowing”.

In 1811, a bill was put before Congress to renew the charter of the Bank of the United States. The debate grew very heated and the legislature of both Pennsylvania and Virginia passed resolutions asking Congress to kill the Bank. The press of the day attacked the Bank openly, calling it “a great swindle,” a “vulture,” a “viper,” and a “cobra.”

A Congressman named P.B. Porter attacked the bank from the floor of Congress, prophetically warned that if the bank’s charter were renewed. Congress, “will have planted in the bosom of this Constitution a viper, which one day or another will sting the liberties of this country to the heart.”

The renewal bill cleared by a single vote in the house and was deadlocked in the Senate, at which point President James Madison instructed his Vice-President, George Clinton, to break the tie and kill the bank.

Second Bank of the United States ¶

By the end of the war of 1812, the American Congress was ready to pass a bill permitting another privately-owned central bank, this time called the Second Bank of the United States, given a charter of twenty years to coin money for the United States and to regulate the value thereof.

You are a den of thieves and vipers, and I intend to rout you out, and by the Eternal God, I will rout you out.

- President Andrew Jackson to the bankers in 1835

By 1836, Andrew Jackson had successfully killed the Second Bank of the United States and in only two years (by January 8, 1838) he paid off the entire national debt. When he was asked what his most important accomplishment had been, he stated without hesitation, “I killed the bank.”

The division of the United States into federations of equal force was decided long before the Civil War by the high financial powers of Europe, these bankers were afraid that the United States if they remained as one block and as one nation, would attain economic and financial independence which would upset their financial domonation over the world. The voice of the Rothschilds predominated. They foresaw the tremendous booty if they could substitute two feeble democracies, indebted to the financiers, to the vigorous Republic, confident and self-providing. Therefore they started their emissaries in order to exploit the question of slavery and thus dig an abyss between the two parts of the Republic.

- Otto Von Bismarck, 1876

President Abraham Lincoln began printing $450,000,000 worth of new currency to help support the military during the Civil War. This money was known as greenbacks because of the green ink it was printed with in order to distinguish them from the other bills in circulation.

The Government should create, issue and circulate all the currency and credit needed to satisfy the spending power of the Government and the buying power of consumers. The privilege of creating and issuing money is not only the supreme prerogative of Government, but it is in the Government’s greatest creative opportunity. By the adoption of these principles…the taxpayers will be saved immense sums of interest. Money will cease to be master and become the servant of humanity.

The money power preys upon the nations in times of peace and conspires against it in times of adversity. It is more despotic than monarchy, more insolent than autocracy, more selfish than bureaucracy.

I have two great enemies, the Southern Army in front of me, and the financial institutions in the rear. Of the two, the one in my rear is my greatest foe.

- Abraham Lincoln

The bankers fought back in 1863 with the National Banking Act, which would create money out of debt by the national banks buying government bonds and issuing them for reserves and banknotes. This scam is best explained by historian John Kenneth Galbraith, who states, “In numerous years following the war, the Federal Government ran a heavy surplus. It could not however pay off its debt, retire its securities, because to do so meant there would be no bonds to back the national bank notes. To pay off the debt was to destroy the money supply.”

My agency in promoting the passage of the National Banking Act was the greatest financial mistake in my life. It has built up a monopoly which affects every interest in the country.

- Salmon P. Chase

The Creature From Jekyll Island ¶

The hard times which occurred after the Civil War could have been avoided if the Greenback legislation had continued as President Lincoln had intended. Instead there were a series of money panics, what we call recessions, which put pressure on Congress to enact legislation to place the banking system under centralized control. Eventually the Federal Resrve Act was passed on December 23rd 1913.

- Theodore R. Thoren and Richard F. Walker, The Truth In Money Book

Back in 1910, Jekyll Island was completely privately owned by a small group of millionaires from New York. We’re talking about people such as J. P. Morgan, William Rockefeller and their associates. This was a social club and it was called The Jekyll Island Club. They owned the island and it was where their families came to spend the winter months. There was a magnificent structure there, the clubhouse, which was the center of their social activities… The island has since been purchased by the state of Georgia, converted into a state park and the clubhouse has been restored and you can visit it… As you walk through the downstairs corridors you’ll come to a door and on the door there is a brass plaque and it says: “In this room the Federal Reserve System was created.” The secret meeting at Jekyl Island in November of 1910 is not a secret anymore; it’s a matter of public record. Around the clubhouse there were some cottages as they were called which were built by some of the families to quarter themselves. They’re attractive little things; they were magnificent examples of the architecture of the turn of the century. One of the cottages through which they take tours, if you’re interested in doing that, as I recall the guide told us that there were 14 bathrooms in that cottage - not exactly what we would call a cottage.

The clubhouse is where the Federal Reserve System was created. The year was 1910, that was three years before the Federal Reserve Act was finally passed into law. It was November of that year when Senator Nelson Aldrich sent his private railroad car to the railroad station in New Jersey and there it was in readiness for the arrival of himself and six other men who were told to come under conditions of great secrecy. For example, they were told to arrive one at a time and not to dine with each other on the night of their departure. They were told that should they arrive at the station at the same time they should pretend like they didn’t even know each other. They were instructed to avoid newspaper reporters at all cost because they were well-known people and had they been seen by a reporter they would’ve asked questions. Especially if two or three of them had been spotted together, this would’ve raised eyebrows and they would’ve asked a lot of questions.

Once they got on board the private railroad car this pattern continued. They were told to use first names only, not to use their last names at all. A couple of the men even adopted code-names. The reason for that is so that the servants on board the train would not know who these people were. They were afraid that if the servants would talk about it then the word would leak out and it might get into the press. They traveled for two nights and a day on board this car and they arrived after a 1,000 mile journey to Brunswick, Georgia. From there they took a ferry across the inland straits and they ended up on Jekyll Island in the clubhouse where for the next nine days they sat around the table and hammered out all the important details of what eventually became the Federal Reserve System. When they were done they went back to New York.

For quite a few years thereafter these men denied that any such meeting took place. It wasn’t until after the Federal Reserve System was firmly established that they then began to talk openly about their journey and what they accomplished. Several of them wrote books on the topic, one of them wrote a magazine article and they gave interviews to newspaper reporters so now it’s possible to go into the public record and document quite clearly and in detail what happened there.

Who were these seven men? The first one I have already mentioned, Senator Nelson Aldrich was the Republican whip in the Senate, he was the chairman of the National Monetary Commission which was the special committee of Congress created for the purpose of making a recommendation to Congress for proposed legislation to reform banking. He was also the very important business associate of J. P. Morgan. He was the father-in-law of John D. Rockefeller, Jr. which means that eventually he became the grandfather of Nelson Rockefeller, our former vice-president. You remember his full name was Nelson Aldrich Rockefeller; his middle name being derived from his famous grandfather.

The second important person there was Abraham Andrew who was Assistant Secretary of the Treasury. He later became a Congressman and he was very important in banking circles.

Frank Vanderlip was there. He was the President of the National City Bank of New York which was the largest of all of the banks in America representing the financial interests of William Rockefeller and the international investment firm of Kuhn, Loeb & Company.

Henry Davison was there, the senior partner of the J.P. Morgan Company. Charles Norton was there; he was the President of the First National Bank of New York which was another one of the giants. Benjamin Strong was at the meeting; he was the head of J.P. Morgan’s Banker’s Trust Company and Benjamin Strong three years later would become the first head of the Federal Reserve System.

Finally, there was Paul Warburg who was probably the most important at the meeting because of his knowledge of banking as it was practiced in Europe. Paul Warburg was born in Germany and eventually became a naturalized American citizen. He was a partner in Kuhn, Loeb & Company and was a representative of the Rothschild banking dynasty in England and France where he maintained very close working relationships throughout his entire career with his brother, Max Warburg, who was the head of the Warburg banking consortium in Germany and the Netherlands.

These were the seven men aboard that railroad car who were at Jekyll Island. Amazing as it may seem, they represented approximately 1/4 of the wealth of the entire world. These are the men that sat around the table and created the Federal Reserve System.

Frank Vanderlip later described the Jekyll Island trip in an article printed in the Saturday Evening Post February 9, 1935:

I do not feel it is any exaggeration to speak of our secret expedition to Jekyll Island as the occasion of the actual conception of what eventually became the Federal Reserve System. We were told to leave our last names behind us. We were told further that we should avoid dining together on the night of our departure. We were instructed to come one at a time and as unobtrusively as possible to the railroad terminal on the New Jersey littoral of the Hudson where Senator Aldrich’s private car would be in readiness attached to the rear-end of a train to the south. Once aboard the private car we began to observe the taboo that had been fixed on last names. We addressed one another as Ben, Paul, Nelson and Abe. Davison and I adopted even deeper disguises abandoning our first names. On the theory that we were always right, he became Wilbur and I became Orville after those two aviation pioneers the Wright brothers. The servants and train crew may have known the identities of one or two of us, but they did not know all and it was the names of all printed together that would’ve made our mysterious journey significant in Washington, in Wall Street, even in London. Discovery we knew simply must not happen… If it were to be exposed that our particular group had got together and written a banking bill, that bill would have no chance whatever of passage by Congress.

Forbes Magazine founder Bertie Charles Forbes wrote several years later:

Picture a party of the nation’s greatest bankers stealing out of New York on a private railroad car under cover of darkness, stealthily hieing hundred of miles South, embarking on a mysterious launch, sneaking onto an island deserted by all but a few servants, living there a full week under such rigid secrecy that the names of not one of them was once mentioned, lest the servants learn the identity and disclose to the world this strangest, most secret expedition in the history of American finance. I am not romancing; I am giving to the world, for the first time, the real story of how the famous Aldrich currency report, the foundation of our new currency system, was written… The utmost secrecy was enjoined upon all. The public must not glean a hint of what was to be done. Senator Aldrich notified each one to go quietly into a private car of which the railroad had received orders to draw up on an unfrequented platform. Off the party set. New York’s ubiquitous reporters had been foiled… Nelson (Aldrich) had confided to Henry, Frank, Paul and Piatt that he was to keep them locked up at Jekyll Island, out of the rest of the world, until they had evolved and compiled a scientific currency system for the United States, the real birth of the present Federal Reserve System, the plan done on Jekyll Island in the conference with Paul, Frank and Henry… Warburg is the link that binds the Aldrich system and the present system together. He more than any one man has made the system possible as a working reality.

Before passage of this Act, the New York bankers could only dominate the reserves of New York. Now we are able to dominate bank reserves of the entire country. -Nelson Aldrich

This is the reason for the secrecy at the Jekyll Island meeting. Now we know something very important about the Federal Reserve that we didn’t know before, but there’s much more to it than that. Consider the composition of this group. Here we had the Morgans, the Rockefellers, Kuhn, Loeb & Company, the Rothschilds and the Warburgs. Anything strange about that mixture? These were competitors. These were the major competitors in the field of investment and banking in those days; these were the giants. Prior to this period they were beating their heads against each other, blood all over the battlefield fighting for dominance in the financial markets of the world. Not only in New York but London, Paris and everywhere. And here they are sitting around a table coming to an agreement of some kind. What’s going on here? We need to ask a few questions.

This is extremely significant because it happened precisely at that point in American history where business was undergoing a major and fundamental change in ideology. Prior to this point, American business had been operating under the principles of private enterprise - free enterprise competition is what made America great, what caused it to surpass all of the other nations of the world. Once we had achieved that pinnacle of performance, however, this was the point in history where the shift was going away from competition toward monopoly. This has been described in many textbooks as the dawning of the era of the cartel and this was what was happening. For the fifteen year period prior to the meeting on Jekyll Island, the very investment groups about which we are speaking were coming together more and more and engaging in joint ventures rather than competing with each other. The meeting on Jekyll Island was merely the culmination of that trend where they came together completely and decided not to compete - they formed a cartel.

The Fraud of 1913 ¶

Senator Aldrich believed the word bank should not even appear in the name of their plan for America’s new central bank. Paul Warburg wanted to call the legislation the National Reserve Bill or the Federal Reserve Bill, but Aldrich insisted it be titled the Aldrich Bill. When this bill was presented to Congress for debate in 1912, it was quickly identified as a bill to benefit the bankers, or a money trust. During this debate, Republican Charles A. Lindbergh stated:

The Aldrich plan is the Wall Street Plan. It means another panic, if necessary, to intimidate the people. Aldrich, paid by the government to represent the people, proposes a plan for the trusts instead.

The Aldrich Bill was condemned in the platform…when Woodrow Wilson was nominated…The men who ruled the Democratic Party promised the people that if they were returned to power there would be no central bank established here while they held the reins of government.

Thirteen months later that promise was broken, and the Wilson administration, under the tutelage of those sinister Wall Street figures who stood behind Colonel House, established here in our free country the worm-eaten monarchical institution of the, ‘King’s Bank,’ to control us from the top downward, and to shackle us from the cradle to the grave.

- Louis T. McFadden

Although the Aldrich Federal Reserve Plan was defeated when it bore the name Aldrich, nevertheless its essential points were all contained in the plan that finally was adopted.

- Frank Vanderlip

Brushing aside the external differences affecting the, ‘shells,’ we find the, ‘kernals,’ of the two systems very closely resembling and related to one another.

- Paul Warburg

The bill grants just what Wall Street and the big banks for twenty-five years have been striving for - private instead of public control of currency. [The Glass-Owen bill] does this as completely as the Aldrich bill. Both measures rob the government and the people of all effective control over the public’s money, and vest in the banks exclusively the dangerous power to make money among the people scarce or plenty.

- Alfred Crozier, 1913

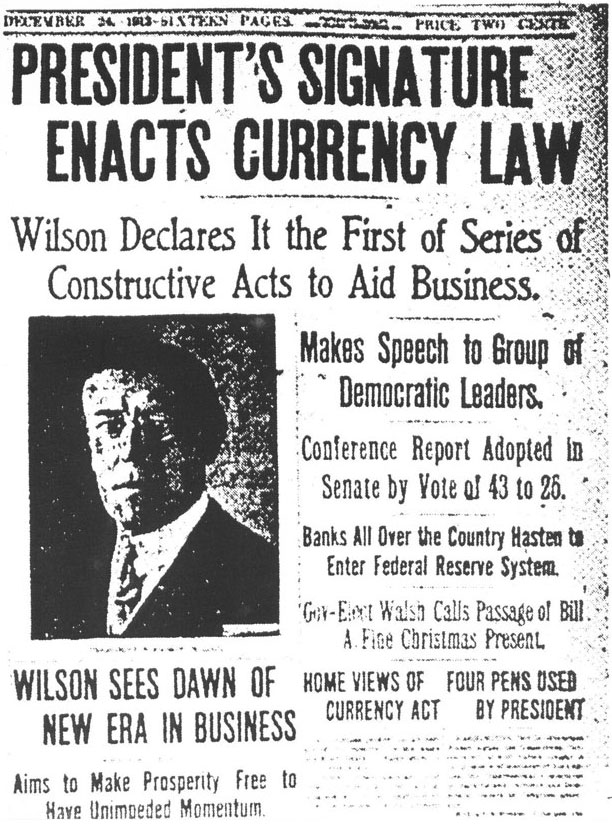

The Glass-Owen bill was passed on December 22, 1913, after many senators had already left town to return home for the holidays. On December 23 the bill was enacted as the Federal Reserve Act, thus creating the private Federal Reserve, which has since been given the power to coin money for the United States and regulate the value thereof. To summarize how the Federal Reserve creates money out of thin air is basically a 4-step explanation:

- The Federal Open Market Committee approves the purchase of U.S. bonds, which are simply promises to pay, or government IOUs.

- The bonds are purchased by the Federal Reserve.

- The Federal Reserve pays for these bonds with electronic credits (based on nothing) to the seller’s bank.

- The banks use these deposits as reserves, so they can then loan out over 10x the amount of their reserves to new borrowers.

For example, a Federal Reserve purchase of $1,000,000 of bonds gets turned into over $10,000,000 in bank accounts. The Federal Reserve in effect creates 10% of this new $10,000,000 and the banks create the other 90%. To reduce the amount of money in circulation, this process is simply reversed. The Federal Reserve sells the bonds to the public and the money flows out of the local banks. Loans must then be reduced by 10 times the amount of the sale, so a Federal Reserve sale of $1,000,000 in bonds may result in $10,000,000 less cash flow in the economy.

The Act establishes the most gigantic trust on earth. When the President signs this Bill, the invisible government of the monetary power will be legalized. The greatest crime of the ages is perpetrated by this banking and currency bill.

To cause high prices, all the Federal Reserve Board will do will be to lower the rediscount rate, producing an expansion of credit and a rising stock market, then when business men are adjusted to these conditions, it can check… prosperity in mid-career by arbitrarily raising the rate of interest.

It can cause the pendulum of a rising and falling market to swing gently back and forth by slight changes in the discount rate, or cause violent fluctuations by a greater rate variation, and in either case it will possess inside information as to financial conditions and advance knowledge of the coming change, either up or down. This is the strongest, most dangerous advantage ever placed in the hands of a special privilege class by any Government that ever existed.

The system is private, conducted for the sole purpose of obtaining the greatest possible profits from the use of other people’s money. They know in advance when to create panics to their advantage. They also know when to stop panic. Inflation and deflation work equally well for them when they control finance.

- Congressman Charles Lindbergh, 1914

This system specifically benefits the bankers who met at Jekyll Island by preventing any future banking reform efforts, as the Federal Reserve is to be the only producer of currency in the United States; by preventing a proper debt-free system of government finance from ever making a comeback, instead the bond-based system of government is now cast in stone. The system also delegates to the bankers the right to create 90% of our money supply based on a fraudulent system of fractional reserve banking and allowing them to loan out this imaginary 90% at interest. In a nutshell, the U.S. Federal Reserve has effectively centralized control of the nation’s money supply in the hands of only a few men.

We have come to be one of the worst ruled, one of the most completely controlled governments in the civilized world - no longer a government of free opinion, no longer a government by … a vote of the majority, but a government by the opinion and duress of a small group of dominant men.

Some of the biggest men in the United States, in the field of commerce and manufacture, are afraid of something. They know there is a power somewhere so organized, so subtle, so watchful, so interlocked, so complete, so pervasive, that they had better not speak above their breath when they speak in condemnation of it.

- Woodrow Wilson, 1916

Already the Federal Reserve Banks have cornered the gold and gold certificates.

- Congressman Charles Lindbergh, 1915

The 16th Amendment ¶

The Congress shall have power to lay and collect taxes on incomes, from whatever source derived, without apportionment among the several States, and without regard to any census or enumeration.

In 1895 the Supreme Court found an income tax law similar to the 16th Amendment unconstitutional. The Supreme Court also found a corporate tax law unconstitutional in 1909. However, the income tax law is fundamental to the Federal Reserve because the system essentially runs up an unlimited federal debt. The only way to guarantee the payment of interest on this debt is to directly tax the people, as is the case with the Bank Of England. The 16th amendment has not been properly ratified, therefore many American citizens do not pay their income tax.

Related Pages ¶

PDF Files ¶

- 1952: Secrets of the Federal Reserve, by Eustace Mullins

- 1994: The Creature from Jekyll Island, by G Edward Griffin

- Who Owns the Federal Reserve